mass tax connect website

Amend your tax return or request an abatement of tax Massgov For earlier tax years you can write Amended return at the top of. Please enable JavaScript to view the page content.

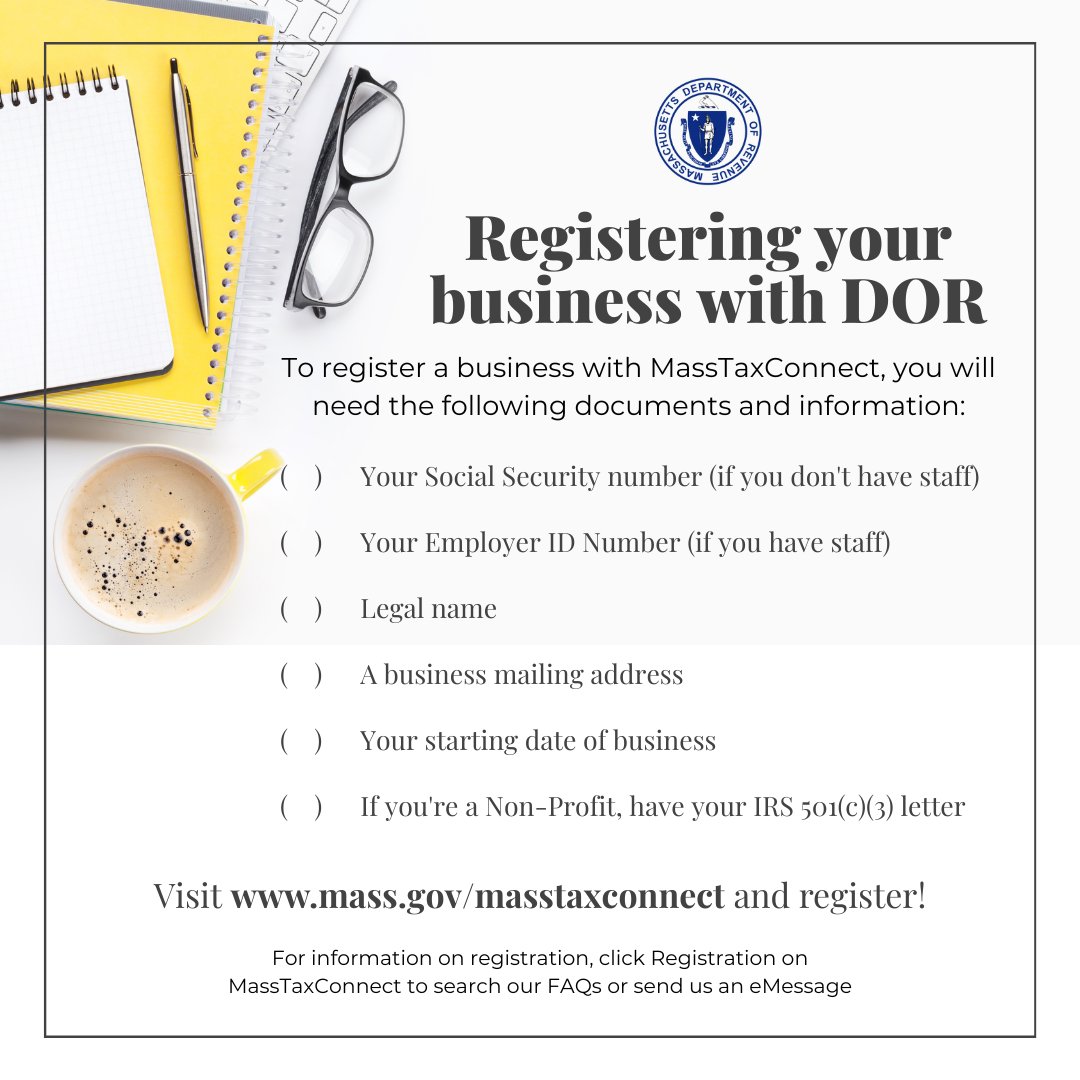

Massachusetts Department Of Revenue Linkedin

Get CASH Benefits Well make a decision within 30 days.

. SBAgovs Business Licenses and Permits Search Tool allows you to get a listing of federal state and local permits licenses and registrations youll need to run a business. Your support ID is. Payments in MassTaxConnect can be deleted from the Submissions screen.

Payments that have a status of In Process or Completed cannot be deleted. The Official Website of the Massachusetts Department of Revenue. With a MassTaxConnect account you can.

Make bill payments return payments estimated tax payments and extension payments from a bank account or using a credit card. Send in Verifications Well give you a list of documents to send in so we can verify your eligibility. Cookies are required to use this site.

Ad Stand Out Online with a Custom Tax Firm Website Trusted by Over 7500 Tax Accountants. 1-800-400-7115 The agencys new online portal to manage accounts for taxpayers. Start a Free Trial to Explore Features and Designs.

The payments must have a status of Submitted to be deleted. Mass Tax ConnectThrough our global network firms we deliver practical and individualized solutions in all areas of tax Please provide instructions on how to opt-out of submitting taxes Coronavirus Tax Relief For questions about filing extensions tax relief and more call. Code of Massachusetts Regulations.

Ad Free 2021 Federal Tax Return. The official search application of the Commonwealth of Massachusetts. A full-year resident is someone who has a home in Massachusetts for the entire tax year or maintains a home in Massachusetts.

To delete a payment i f the payment was made while logged into an MassTaxConnect account. Page Last Reviewed or Updated. Furthermore you can find the Troubleshooting Login Issues section which can answer your unresolved problems and equip you with a lot of relevant information.

Connect to a reliable connection to the internet and start completing documents with a court-admissible signature within a few minutes. Change or cancel payments previously scheduled through MassTaxConnect. Search the Commonwealths web properties to more easily find the services and.

LoginAsk is here to help you access Log Into Mass Tax Connect quickly and handle each specific case you encounter. Massachusetts Department of Revenue DORs Best Toll-Free800 Customer Phone Number -By Tracy Hess CPA On December 28 2018 the Governor of Massachusetts signed legislation to extend its occupancy tax sales tax on residential rentals to include short-term rentals. The full-year residents must file Form 1 Massachusetts Resident Income Tax Return.

Access account information 24 hours a day 7 days a week. Get a Secure Easy-to-Use Website. E-File Directly to the IRS State.

Initiate an Application This should take about 10 minutes. Find your massachusetts tax id numbers and rates massachusetts withholding account number deposit frequency. Massachusetts residents who earn a gross income of at least 8000 need to file a tax return.

Please enable JavaScript to view the page content. The TAFDCEAEDC Application Process. Connect Mass Tax - florencenewspaperfirenzeit Search.

Your browser appears to have cookies disabled. To access employer account information enter your user id and password may 29 2020 normally april 30 february 29 th march 31 st and may 29 th the mission of the department of revenue is the timely courteous and prompt collection. Phone Call We will call you to complete your application.

Massachusetts state organizations A to Z. How to make an signature for the Massachusetts ABT Form on Android OS. How do I delete a payment.

Navigate to the S earch S. Your support ID is. Submit and amend most tax returns.

Tax Guide For Pass Through Entities Mass Gov

Faqs On Room Occupancy Tax Regarding Short Term Rentals In Massachusetts Veterans Services Massachusetts Camping Massachusetts

Massachusetts Dept Of Revenue Massrevenue Twitter

Sales And Use Tax For Businesses Mass Gov

Massachusetts Dept Of Revenue Massrevenue Twitter

Massachusetts Department Of Revenue

Opt In And Contribute To Paid Family And Medical Leave As A Self Employed Individual Mass Gov

Massachusetts Sales Tax Small Business Guide Truic

Massachusetts Sales Tax Guide And Calculator 2022 Taxjar

Massachusetts Dept Of Revenue Massrevenue Twitter

Massachusetts Department Of Revenue

Massachusetts Department Of Revenue

Massachusetts Department Of Revenue Tax Guides Mass Gov

Massachusetts Department Of Revenue

Massachusetts Department Of Revenue Linkedin

Massachusetts Dept Of Revenue Massrevenue Twitter

Massachusetts Dept Of Revenue Massrevenue Twitter

2021 Personal Income And Corporate Excise Tax Law Changes Mass Gov